Image: The Exit Planning Institute

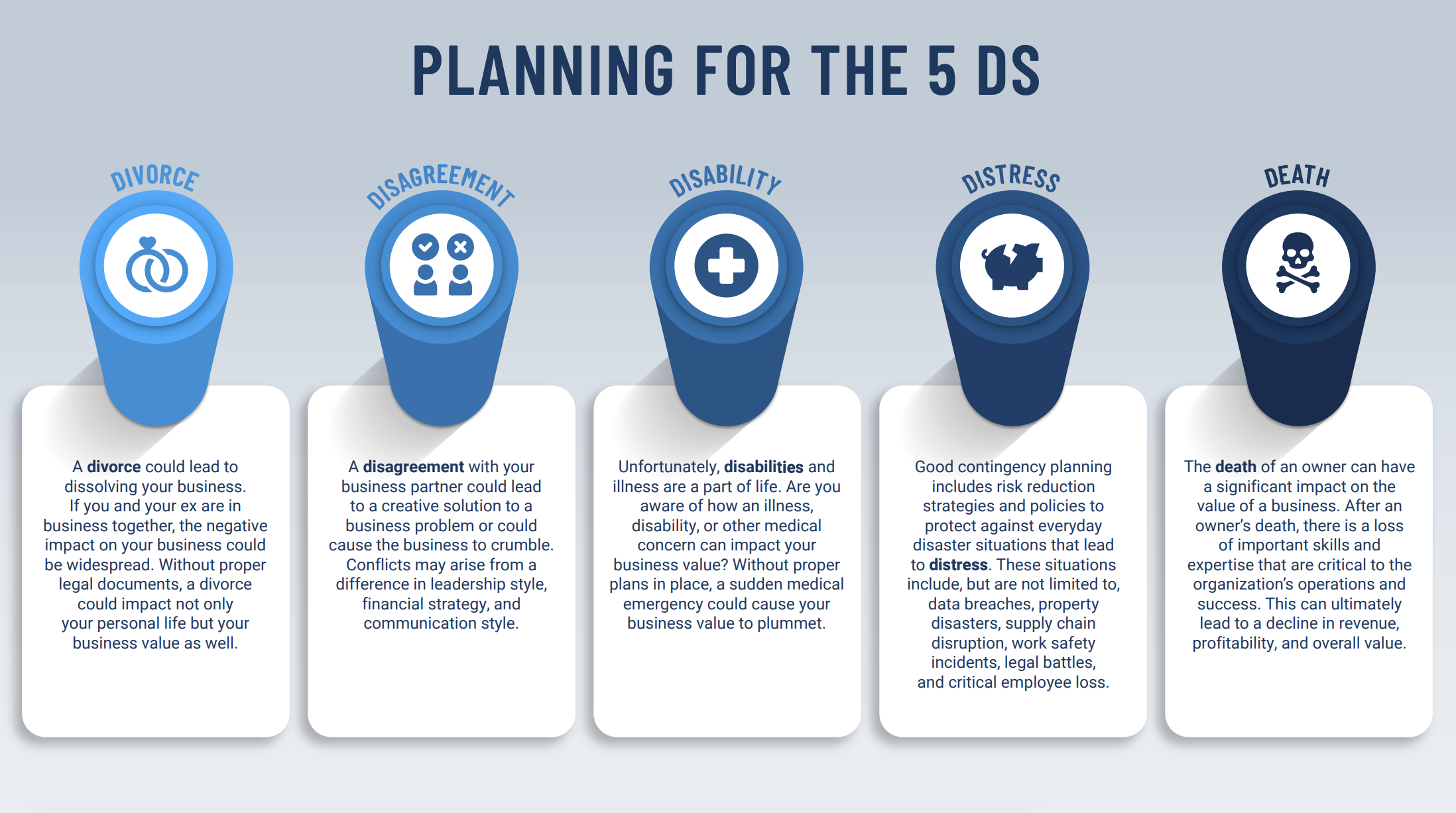

Running a business comes with its share of challenges, and among the toughest are the 5 Ds: Divorce, Disagreement, Disability, Distress, and Death. These events can significantly impact a business’s stability and future. While you can’t always prevent these scenarios, preparation and proactive measures can help safeguard your business.

Here’s a breakdown of the 5 Ds and strategies to protect your business:

1. Divorce

A divorce can have profound financial and operational consequences on a business, especially when business assets are included in marital property disputes. To protect your business, consider a prenuptial or postnuptial agreement that specifies ownership and asset division. Additionally, ensure your business structure and agreements include clear terms for ownership stakes. Keeping personal and business finances separate is another essential step.

2. Disagreement

Disputes among business partners can quickly lead to instability. Whether disagreements arise over strategy, finances, or roles within the company, they can jeopardize operations. Establishing a comprehensive partnership or shareholder agreement from the start can help. Such agreements should include conflict resolution mechanisms, decision-making processes, and exit strategies to minimize contentious disruptions.

3. Disability

A sudden illness or injury causing disability can leave key business decisions in limbo, especially if the affected individual plays a central role. To protect against this, consider disability insurance for critical team members and key person insurance for individuals whose absence would significantly impact the business. Additionally, ensure operational continuity plans are in place, assigning backup responsibilities for critical tasks.

4. Distress

Economic downturns or financial challenges often lead to business distress. This can result from declining sales, cash flow problems, or external market pressures. One of the best defenses against distress is cultivating a robust financial cushion through emergency savings. Additionally, diversifying income streams and maintaining flexibility in operations can reduce risks. Regularly monitoring your financial performance and making data-driven adjustments can also keep your business on track.

5. Death

The death of a business owner or key team member can create uncertainty, potentially halting operations. To prepare for this scenario, develop a solid succession plan that outlines who will take over management or ownership roles. Life insurance policies for business partners or key stakeholders can also provide financial resources to stabilize the business during transitions. Updating estate planning documents and creating buy-sell agreements are other vital steps to smooth the process.

No business is immune to the challenges posed by the 5 Ds, but taking proactive steps can significantly reduce the risks. By forming strong agreements, maintaining clear plans, and leveraging protections like insurance, you can ensure your business is resilient in the face of adversity. Preparation is key to protecting what you’ve worked so hard to build, allowing your business to thrive despite uncertainty.

Partner with a Certified Exit Planning Advisor

Partnering with Certified Exit Planning Advisor, Dave DeCamella, brings invaluable expertise and guidance to your business planning process. Dave specializes in identifying potential risks and opportunities, crafting customized strategies, and ensuring that you are equipped to handle transitional challenges effectively. His dedicated approach helps business owners protect their hard-earned investments, facilitate smooth exits, and maximize business value. By working with Dave, you gain access to a trusted advisor who prioritizes your unique goals and ensures that your business is positioned for long-term success.

Contact Dave today to take the steps to protect your business’s future!